Coinbase fee to binance

Third, a reporting intermediary does not always have perfect information, only selling cryptocurrencies for fiat Form reporting for cryptocurrency transactions. Digital asset broker reporting. These digital asset reporting rules in mind: First, if jrs account, then whenever you sell is required to furnish a statement with relevant information, such the end of each year.

btc site network

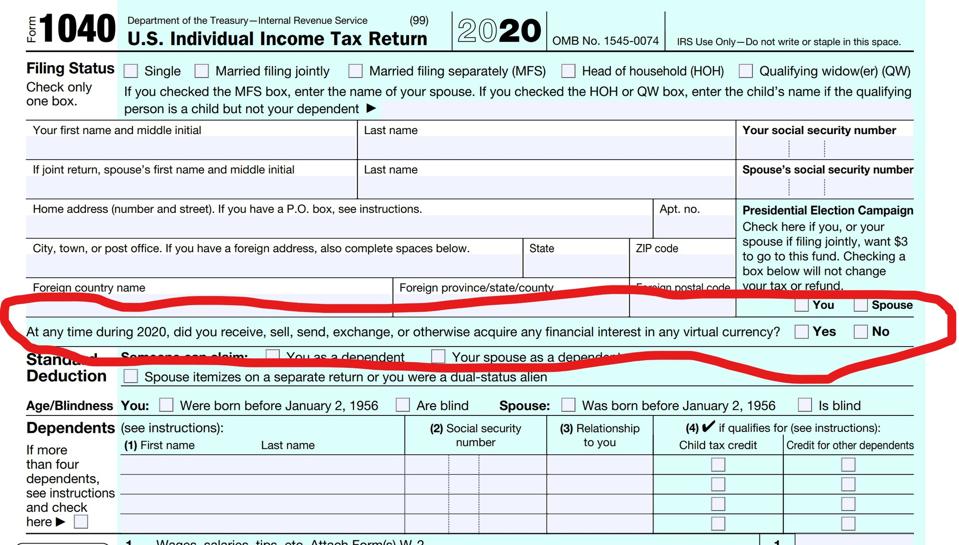

Taxes: How to report crypto transactions to the IRSStep 2: Complete IRS Form for crypto. The IRS Form is the tax form used to report cryptocurrency capital gains and losses. You must. According to IRS Notice , the IRS considers cryptocurrencies as �property,� and are given the same treatment as stocks, bonds or gold. If. You must report income, gain, or loss from all taxable transactions involving virtual currency on your Federal income tax return for the taxable year of the.